By: Fatou Krubally

The National Assembly on Wednesday sharply questioned government inaction over the growing chaos in the country’s unregulated foreign exchange trading hotspots.

The trading hotspots, they said, include: Westfield, Bamboo (Traffic Light), Brikama, and other busy trading zones.

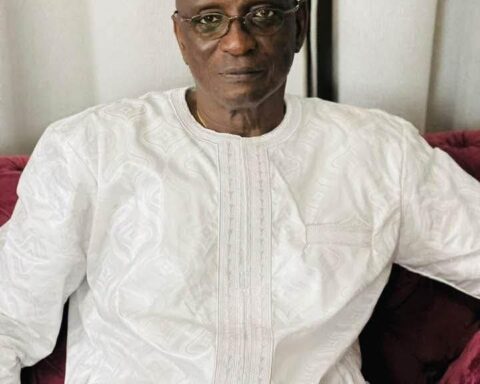

The Finance Minister, Seedy Keita faced a barrage of questions as lawmakers raised alarm over the daily activities of informal currency dealers operating openly with no oversight. Members warned that the parallel market commonly called the “black market” is contributing to the depreciation of the dalasi and distorting the economy.

“If you go to Westfield, you see people with bags full of currencies. How do you trace the amount they hold or the transactions they conduct?” Honourable Almameh Gibba member for Foni Kansala asked. “We should be able to set rules governing how people exchange currency.”

Member for Sabach Sanjal Alagie Babou Ceesay noted that the unregulated dealers now “determine their own rates” for dollars, Euros, and CFA francs, causing instability that affects ordinary citizens, traders, and importers.

Minister Keita, in response, acknowledged the severity of the issue. “It is an unregulated market,” he admitted. “It does have an impact on the exchange rate, but that impact is hard to quantify.”

He told the Assembly that the Ministry and the Central Bank have held several meetings on the matter and are working on regulatory reforms. These include licensing requirements, updated fintech guidelines, real-time electronic reporting systems for exchange bureaus, and coordinated strategies to shift transactions to the formal sector.

But he emphasized that enforcement must be approached cautiously.

“It’s a free market,” he said. “If you want to use force, you can push them underground, which will make regulation harder. We need to tread carefully.”

Lawmakers were unimpressed with the pace of progress. “It cannot take government forever,” said Honorable Lamin Ceesay the Member for Kiang West. “We have argued this over and over. The forex crisis at Bamboo and Westfield is no longer a secret. How soon will we see action?”

The Minister responded that work was on-going and that progress would be realized “soon enough for it to have impact.”

Earlier, he explained that currency depreciation was driven by demand and supply dynamics, not simply ministerial policy. “Currency behaves like any security,” he said. “We can put strategies in place, but market reaction is beyond our control.”

As the session ended, the assembly made it clear that regulation of the parallel market remains a pressing national concern one the government can no longer afford to delay.

The post Lawmakers Question Delays in Regulating Forex Chaos at Westfield and Bamboo appeared first on .

By: Fatou Krubally The National Assembly on Wednesday sharply questioned government inaction over the growing chaos in the country’s unregulated…

The post Lawmakers Question Delays in Regulating Forex Chaos at Westfield and Bamboo appeared first on .