By Haddy Touray

The Central Bank of The Gambia (CBG) has reduced its Monetary Policy Rate by 100 basis points to 16 percent, citing a slowdown in the global economic recovery and persistent risks to the outlook.

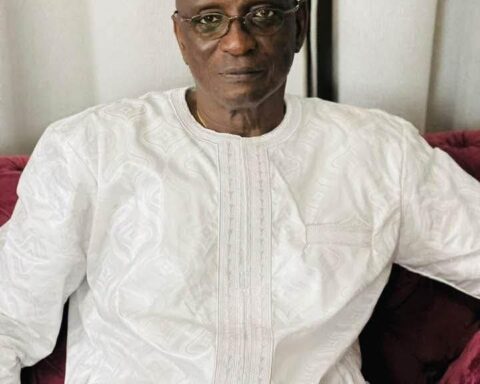

The decision was announced by Governor Buah Saidy at the end of the Monetary Policy Committee (MPC) meeting held on 3–4 December 2025.

Saidy said the global economy, after a strong start to the year, is “losing momentum”, with growth projected at 3.2 percent in 2025 and 3.1 percent in 2026, below the pre-pandemic average of 3.7 percent, according to the International Monetary Fund (IMF).

He noted that advanced economies are expected to expand by 1.6 percent, while emerging markets and developing economies will grow by 4.2 percent. Sub-Saharan Africa’s output is forecasted to rise by 4.0 percent, supported by easing inflation and a more stable exchange-rate environment, though recovery remains uneven across the region.

“Global inflation continues to ease, with projections of 4.2 percent in 2025 and 3.7 percent in 2026, driven by lower energy prices and improved supply conditions,” he said. The slowdown, he added, is more marked in the euro area and Asia, while many developing economies still face elevated food and energy costs, currency depreciation and fiscal pressures.

Commodity prices are expected to remain soft in 2025, with crude oil averaging US$66.9 per barrel, down from US$79.2 in 2024. Food prices have stabilised, though risks remain from trade tensions, geopolitical developments and climate-related shocks. The FAO Food Price Index fell by 1.6 percent between September and October 2025, while the FAO Rice Price Index declined by 2.5 percent.

Turning to the domestic economy, Saidy said The Gambia recorded strong growth in 2024, with the Gambia Bureau of Statistics revising real GDP growth upward to 5.6 percent. The CBG maintains its 2025 growth forecast at 6.4 percent, supported by robust public and private investment and improved performance in services, construction and agriculture.

He said remittances and public investment continue to bolster domestic demand, although global uncertainty and commodity-price volatility pose downside risks. The Central Bank’s Business Sentiment Survey for the third quarter of 2025 shows rising optimism among firms, with most anticipating better conditions in the fourth quarter. Inflation expectations, although still elevated, are easing in line with the decline in headline inflation.

Saidy reported that the current account deficit narrowed to US$66.7 million (2.8 percent of GDP) in the first nine months of 2025, compared with US$78.7 million (3.3 percent of GDP) over the same period in 2024. The improvement is attributed to higher tourism earnings, increased exports and steady remittance inflows.

The goods account deficit also declined to US$698.7 million (29.1 percent of GDP), from US$727.9 million (30.5 percent of GDP) a year earlier. Imports rose by 2.9 percent to US$1.0 billion, driven by electricity, fuel, construction materials and food items, while exports increased by 22.8 percent to US$309.6 million.

The post Central Bank Cuts Policy Rate As Global Recovery Slows down appeared first on .

By Haddy Touray The Central Bank of The Gambia (CBG) has reduced its Monetary Policy Rate by 100 basis…

The post Central Bank Cuts Policy Rate As Global Recovery Slows down appeared first on .