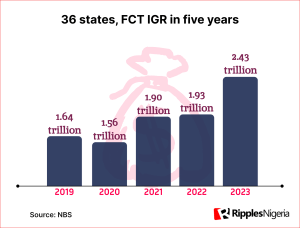

Lagos, Rivers, and the Federal Capital Territory led in Internally Generated Revenue (IGR) for 2023, with figures of N815.86 billion, N211.10 billion and N195.41 billion respectively. According to a National Bureau of Statistics report, the total IGR across Nigeria’s 36 states and the Federal Capital Territory reached N2.43 trillion in 2023.

The NBS further highlighted that tax revenues during the period included various sub-categories, such as Pay As You Earn, direct assessment, road taxes, stamp duties, capital gains tax, withholding taxes, other taxes, and local government area (LGA) revenues

Data collated by Ripples Metrics showed that between 2019 and 2022, Nigeria’s 36 states and the Federal Capital Territory generated a total of N7.02 trillion in internally generated revenue (IGR).

In 2019, state IGR was N1.64 trillion, with tax revenue accounting for 64.65 per cent. This figure dropped by 4.65 per cent to N1.56 trillion in 2020, likely due to the global economic impact of the COVID-19 pandemic, which led many economies, including Nigeria’s, into recession. However, the share of tax revenue rose to 66.16 per cent in 2020.

Revenue rebounded in 2021, reaching N1.895 trillion, a 21.54 per cent increase from 2020. This growth continued with a 1.57 per cent rise to N1.93 trillion in 2022.

Personnel Cost and IGR

Further analysis by RipplesMetrics revealed that 27 states would be unable to cover their 2023 budget’s personnel costs solely with the internally generated revenue (IGR) for that year, even if all IGR were allocated to the budget. The affected states would rely on local or external borrowing, multilateral loans, FAAC allocations, grants, and aid to fund their budgets.

Personnel costs in a fiscal budget refer to the total expenditure on employee salaries and benefits within the government system. By this, only nine states generated an IGR higher than the recurrent expenditure allocated in 2023.

READ ALSO: RipplesMetrics: Ministerial reshuffle and the cost of governance

These states are Delta, Ebonyi, Edo, Ekiti, Kaduna, Kwara, Lagos, Ogun and Rivers states.

The filtered data also revealed that 19 of the 27 states could cover at least 10 months of budgeted personnel costs, while the remaining eight states faced difficulties. These eight states are Baleysa, Taraba, Yobe, Niger, Kebbi, Adamawa, Akwa Ibom, and Benue.

For instance, the Bayelsa state budget for personnel cost was N81.78 billion, however, the state generated an IGR of N19.82 billion. If the IGR is used to offset personnel costs, it can only pay for eight months leaving four months outstanding.

Similarly, the personnel cost approved for Taraba state in 2023 was N37.62 billion, but the state generated an IGR of N10.87 billion, which can only offset nine months of personnel expenditure.

Meanwhile, the reliance of many states on Federal Account Allocation Committee (FAAC) revenue was highlighted in a new report by civic-tech organization BudgIT. The report revealed that in 2023, at least 32 states depended on federal revenue for at least 55 per cent of their total income.

BudgIT’s 2024 State of States reports further noted that 14 states relied on FAAC allocations for at least 70 per cent of their total revenue. Additionally, federal transfers made up at least 62 per cent of the recurrent revenue in 34 states—excluding Lagos and Ogun. In 21 states, these federal transfers accounted for at least 80 per cent of recurrent revenue.

By: James Odunayo

The post RipplesMetrics: Only 9 states can fund personnel costs with IGR appeared first on Latest Nigeria News | Top Stories from Ripples Nigeria.