Nigeria’s public debt reached N142.3 trillion as of September 30, 2024, marking an increase of N8.02 trillion from the previous quarter. The Debt Management Office (DMO) attributed the 5.97% rise to the Naira’s depreciation, which has escalated the cost of external debt obligations.

External debt now stands at N68.88 trillion (48.4% of total debt), a 9.22% rise in naira terms from the previous quarter. Meanwhile, domestic debt grew by 3.10% in naira terms, reaching N73.43 trillion.

Despite the increase, Nigeria’s debt-to-GDP ratio remains under the IMF’s 60% threshold for emerging markets. However, the DMO’s self-imposed debt ceiling of 40% has been surpassed, raising concerns over the country’s economic stability amid weak revenues and ongoing foreign exchange volatility.

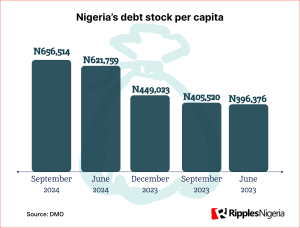

However, if the debt stock per capita is divided across the country’s estimated population of 216.78 million, each Nigerian would owe N656,514. Ripples Metrics calculated the debt stock per capita by dividing the total public debts of the country by the country’s population.

This is higher than the N405,520 owed in September 2023. In the past year, the Nigerian government borrowed an additional N250,994 per person, contributing to the country’s growing debt.

To further understand how huge the debt stock per capita has grown, Ripples Metrics calculated the repayment of the debts based on the minimum wage an average Nigerian would earn if he/she were to repay.

READ ALSO: RipplesMetrics: 34 Nigerian states to spend N25.49 trillion as budget in 2025

Recall that in July 2024, President Bola Tinubu signed the minimum wage bill into law, ending months of deliberations between government authorities, labour unions, and the private sector. By this, the minimum wage was increased from N30,000 to N70,000.

If 216.78 million Nigerians earn N70,000 monthly and dedicate their entire salary to repaying Nigeria’s debt, it would take nine months for the total debt to be repaid.

However, there have been mixed reactions that most states are yet to implement the new minimum wage. If the average Nigerian still earns 30,000, it would take 22 months, almost two years, to repay the debts.

Meanwhile, the challenge of this is that over 133 million of the country’s population is in multidimensional poverty. This means that only 83.78 million Nigerians might be capable, based on employment, to repay the loan.

Recall that Ripples Nigeria had reported that Tinubu said servicing debt at a 97% ratio was unsustainable. This is even as he disclosed that Nigeria’s debt service-to-revenue ratio has dropped from approximately 97% to 65% since he took office 17 months ago.

By: James Odunayo

The post RipplesMetrics: N142TN DEBT: As part of Nigeria’s 216m population, govt has borrowed N656,614 on your behalf appeared first on Latest Nigeria News | Top Stories from Ripples Nigeria.